Over the last four years there has been much public debate about the benefits and costs associated with certain tax provisions in effect in Ohio. Our organization’s mission is to provide non-partisan, educational resources on public policy issues that may impact Ohio’s economy, job creation, and long-term competitiveness. Therefore, the Ohio Chamber of Commerce Research Foundation set out to investigate the economic impact of the Business Income Deduction and 3% flat rate on business income (known as the BID) as there has been no comprehensive, data-driven analysis of the BID to date. We contracted with Ernst & Young (EY) to conduct a study on the econometric effects of the BID, and the results of the analysis show there is a positive correlation between the enactment of the BID and a growth in economic activity and production in Ohio.

The BID, initially enacted in 2013 and updated to its current implementation for tax years 2016 and beyond, allows taxpayers filing an individual tax return with business income to deduct up to $125,000 of that business income (if single or married filing separately) or $250,000 of that business income (if married and filing jointly), with any remaining business income taxed at a 3% rate as opposed to the top individual marginal rate of nearly 4.8%. The stated goal of the BID was to allow business owners to retain more of their capital, allowing them to reinvest those dollars into their operations and spur economic activity. Thus, a method of assessing the impact of the BID is to investigate whether increased economic activity has occurred when compared to levels of economic activity prior to the enactment of the BID.

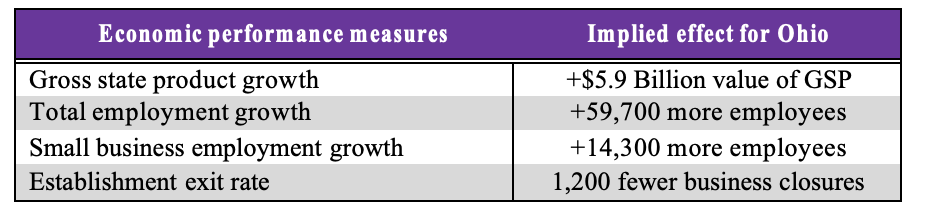

When controlling for other variables such as the economic and demographic characteristics of the state and taking into account other factors such as trends in the national economy, the analysis conducted by EY demonstrates that there was roughly $5.9 billion in increased economic activity in Ohio in 2018, when compared to an economic model in which the BID was not in effect. Further, these models suggest that the effect of the BID on Ohio’s economy supported nearly 60,000 jobs, including 14,000 jobs at businesses with less than 50 employees, and helped to keep 1,200 businesses from potentially closing.

Source: “Analysis of Ohio’s Business Income Tax Incentives,” Ernst & Young, April 2021

As the report confirms, because the BID is a deduction on the total business income claimed by taxpayers on their individual tax return, the deduction is not multiplied by ownership in several businesses.[1] The report also makes clear that the BID provides the most benefit to those taxpayers with the lowest adjusted gross income (AGI). In 2018, 66% of the business income covered by the deduction flowed to taxpayers with an AGI of less than $400,000, per data from the Ohio Department of Taxation.

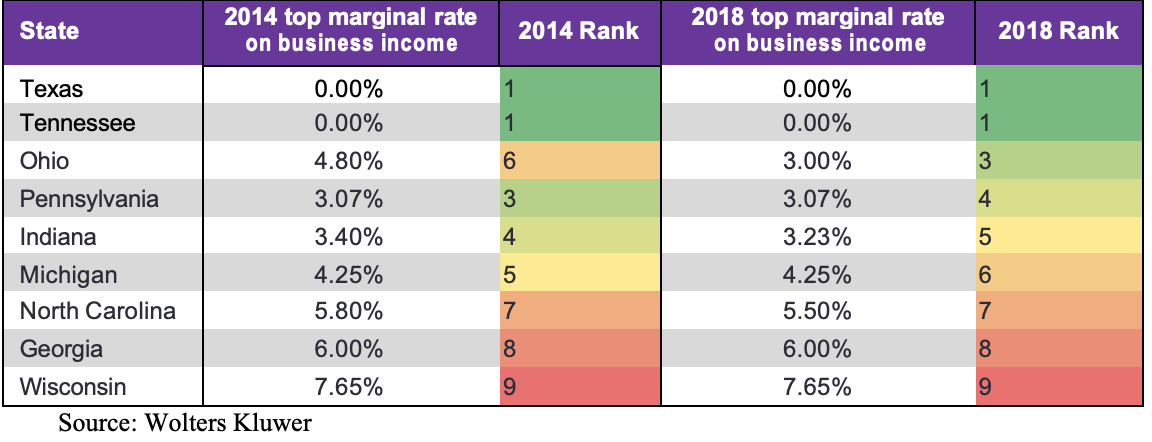

When comparing Ohio’s individual income tax rates on business income to that of neighboring or peer states across the country, it becomes clear that Ohio is a much more attractive place for a small business to grow with the BID in effect. Among nine states compared in the table below, Ohio ranked sixth with a top marginal individual rate on busines income of 4.8%. With the BID in effect, we trail only Texas and Tennessee among this group, states with a 0% tax on most business income. The BID also offsets the anti-competitive impact of Ohio’s significant municipal tax on net profits of businesses, which can add an additional 0.5-3% to the Ohio tax rate on business income.[2]

Regional and selected state comparison of top marginal individual rates on business income, 2014 & 2018

In conclusion, we set out to determine whether the introduction of the Business Income Deduction had a noticeable effect on the state economy in Ohio. The econometric analysis performed by EY provides data that suggests the BID supported almost $6 billion in economic activity in 2018. The models also suggest the economic activity supported nearly 60,000 jobs and suggest that the provisions helped keep 1,200 businesses open. Based on those results, it is our opinion that the BID has had the intended effect of spurring increased economic activity and incentivizing small business owners to reinvest those tax savings back into their operations.

To download a PDF of this document, please click here.

To download the full Ernst & Young report, “Analysis of Ohio’s Business Income Tax Incentives,” please click here.

[1] https://tax.ohio.gov/static/forms/ohio_individual/individual/2019/schedule_itbus_fi.pdf. In other words, the so-called “LLC Loophole” whereby some have asserted that an owner can divide a business into multiple LLCs to obtain multiple deductions of up to $250,000 for each LLC is non-existent.

[2] Ohio Department of Taxation Annual Report, Fiscal Year 2020, Municipal Income Tax, p. 122.

614-228-4201 | 34 S. THIRD STREET, STE 100 | COLUMBUS, OH 43215

COPYRIGHT 2025 OHIO CHAMBER OF COMMERCE | ALL RIGHTS RESERVED